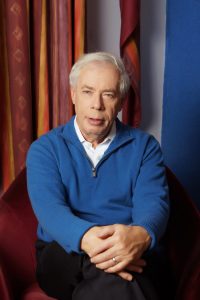

John Kay is one of Britain’s leading economists. His work is centred on the relationships between economics, finance and business. His career has spanned academic work and think tanks, business schools, company directorships, consultancies and investment companies. Today his main focus is on writing and he is renowned for his ability to express complex ideas clearly and succinctly.

John has been a Fellow of St John’s College, Oxford since 1970. In 1979 he became research director and then director of the Institute for Fiscal Studies, establishing it as one of Britain’s leading think tanks with a fearsome reputation for independence. In 1986 he founded an economic consulting business which became Europe’s leading autonomous economics consulting company. He was the first dean of Oxford’s Said Business School and has held chairs at London Business School, the University of Oxford, and the London School of Economics. He is a Fellow of the British Academy and the Royal Society of Edinburgh.

Born and educated in Edinburgh, he has been a member of the Scottish Government’s Council of Economic Advisers and chaired the Review of Equity Markets and Long Term Decision Making which reported to the UK government’s Department of Business, Innovation and Skills. Following the outcome of the referendum on British membership of the European Union in June 2016, he was appointed a member of the Standing Council on Scotland and Europe appointed by the First Minister of Scotland, Nicola Sturgeon.

John Kay is a director of several public and private companies. He is the author of many articles and has contributed regularly to the Financial Times for over 20 years. His books include Foundations of Corporate Success (1993), The Truth about Markets (2003) and Obliquity (2011): his most recent book, Other People’s Money, was published in 2015 to wide acclaim. The second edition of his 2009 book The Long and the Short of It – finance and investment for normally intelligent people who are not in the industry was published in November 2016. Radical Uncertainty, jointly written with Mervyn King, was published in March 2020, and Greed is Dead, jointly written with Paul Collier, was published in July 2020.

John’s work has been honoured by many different bodies. He became Commander of the British Empire in the Queen’s New Year Honours List of 2014, and was knighted in the Queen’s Birthday Honours List of 2021. He has been elected an honorary fellow of the Society of Investment Professionals and the Chartered Institute of Taxation and received the Daniel J Forrestal III award for Leadership in Professional Ethics and Standards of Investment Award from the Chartered Financial Analysts Institute. He has been awarded honorary degrees by Heriot Watt University, and his alma mater the University of Edinburgh. The Truth about Markets was declared Politics Book of the Year in 2005 by the Political Studies Association. He received the Senior Wincott Award for Financial Journalism in 2011 for his Financial Times columns; Other People’s Money was a book of the year for The Economist, Financial Times, and Bloomberg and was shortlisted for the Orwell Prize for Political Writing.

Most business people think that the job of the economist is to predict whether exchange rates will go up or down. Economists are not very good at predicting whether exchange rates will go up or down, with the result that business people have very little regard for economists.

Most business people think that the job of the economist is to predict whether exchange rates will go up or down. Economists are not very good at predicting whether exchange rates will go up or down, with the result that business people have very little regard for economists.

My interests are different. Virtually all my work has been in microeconomics. My professional objective is to use the tools of economics to understand change in the structure of firms, industries and markets. So do not look on this site for predictions of exchange rate or forecasts of economic growth: you will not find them.

September 2016

My work is concerned with the interaction between economics and business. Pluralism is the guiding principle of my work and my approach to it. Isaiah Berlin famously wrote ‘there exists a great chasm between those, on one side, who relate everything to a single central vision and, on the other side, those who pursue many ends, often unrelated and even contradictory. The first kind of intellectual and artistic personality belongs to the hedgehog, the second to the fox’. I seek, unequivocally and unapologetically, to be the fox who seeks to know ‘many little things’, rather than the hedgehog who knows ‘one big thing’.

Four axioms follow:

- tell it how it is

- markets operate in a social context

- consistency is an overrated axiom

- economics must be studied in a pluralist manner

Tell it how it is

The years between 1979 and 1986 were perhaps the most formative experience of my life. At that time I was Director of the Institute for Fiscal Studies, and helped it to developed from an embryo into perhaps the most respected of UK think tanks. From the outset, I and my colleagues determined that our work would be driven by data and that we would follow that data wherever it led us. People who joined our staff might carry ideological baggage with them – why else would they be interested in policy research? – but they must leave that baggage at the door.

‘We are interested in ensuring that policy is made well’, I would tell new recruits, ‘and what that policy is must be secondary’. Many outsiders found this perspective difficult to understand, and some of those who worked for us left to pursue their political or ideological objectives elsewhere. But most of those who worked at IFS found this approach refreshing, and so did journalists, and although many politicians hated us – and some tried to close us down – IFS not only survived but thrived. In the thirty years since I left, IFS has only enhanced the reputation for objectivity it acquired in these early years.

Telling it how it is ought to be the norm, in academia and in policy. And yet you so often know what someone will say about an event before they open their mouth, or even before it has occurred. It no longer surprises me, but it still shocks me, how many people discovered that the 2008 global financial crisis only served to confirm what they had been saying all along.

Markets operate in a social context

A popular caricature of the market economy sees it as populated by greedy people pursuing their own financial self interest. The genius of the market economy is that it coordinates such behaviour, not only to the degree necessary to prevent chaos (the common sense prediction of the likely outcome of uncoordinated behaviour) but to achieve the most efficient allocation of resources possible.

There is an element of truth in this account, but only an element, and the remarkable character of that truth has blinded many people to an understanding of the complex social and political context in which markets actually function. The epitome of an economy populated by self-interested opportunists is Nigeria (or Lehman Bros). The Nigerian economy does not function effectively and Lehman was destroyed by the conflicting self interests of its own employees

Property rights are a social construction, not a fact of nature, and the misallocation of property rights leads to economic inefficiency and social dissension. In successful market economies, self-interested behaviour is mediated, and agreements enforced, by trust relationships.

Risks are largely mutualised, and there is necessarily far more cooperative activity than the individualist caricature allows. In the absence of a widely shared sense of the legitimacy of both its processes and its outcomes, the market economy fails to operate effectively.

Most people are interested in money, but not exclusively so, and the evidence that their happiness depends more on their personal and working relationships than their material position is clear. The real strength of market economies does not lie in the overriding motivating power of cash incentives but in what I have called disciplined pluralism. Successful market economies allow individuals and businesses considerable freedom to innovate (pluralism) but provide honest feedback (discipline) through customer choice. The result is that successful innovations are widely imitated and unsuccessful ones quickly dropped. The key role of disciplined pluralism was the principal theme of my book The Truth about Markets.

Consistency is overrated

To the economist, almost every problem is a maximisation problem. Behind this way of thinking is a mathematical proposition: if individuals behave consistently, their behaviour can be described as maximisation. ‘Utility’ is often used as shorthand for whatever it is that these consistent individuals maximise. Similarly, businesses are assumed to maximise profits.

As I learnt more about business, it became obvious to me that though profit was certainly a business objective, companies did not maximise profits. In fact, when you start to think of profits as a stream of revenues over time, no one could prescribe with any clarity what companies should do to maximise their profits. So I found myself posing the question, natural to the economist: if companies did not maximise their profits, what did they maximise? A few heterodox economists had made alternative suggestions. Perhaps companies maximised sales, or revenues, or their rate of growth.

A moment of revelation led me to realise; perhaps companies did not maximise anything. Companies were pluralist in their objectives, as were individuals. The corporation was a political organisation, populated by individuals with different goals and purposes, sometimes compatible, often conflicting.

The senior executives of any organisation were tasked with managing this variety of expectations, buffeted by the competing demands of their investors, their employees, their suppliers and their customers. The role of the manager was to balance these factors, steering the company to survival and success. And survival was itself the measure of success – for the manager and for the company itself. The process of balancing incompatible demands was the reality of everyday life for both individual and corporation. This was the theme of my book Obliquity.

‘A foolish consistency is the hobgoblin of little minds, adored by little statesmen and philosophers and divines’, wrote Ralph Waldo Emerson. Consistency, as used in economics, is the requirement that the same choice is always made in the same situation. But in the complex real world of business and finance, there is no objective means of determining whether two situations are the same, or different. One person’s consistency (insisting that things have not changed) is another’s stubbornness (failing to recognise that they have). The attempt to analyse economic systems in terms of maximising behaviour is an approach far less powerful than it appears at first sight.

Pluralism in economics

My fourth axiom in large part follows from the first three – the rejection of ideology, the insistence on social context, the scepticism of the universality of maximising behaviour. The dominant paradigm in economics today is that of rational choice. This paradigm is widely criticised, notably by practical men – who dislike the whole idea of simplifying models – and by students, who would like an approach gentler in both its view of human behaviour and in its demands on their mathematical competence.

My reaction to these kinds of debate is determinedly pluralist. I believe that neo-classical economics offers many insights and should certainly not be discarded. But I also believe that to regard such rational choice modelling as the only valid way of looking at the world is wholly, and ridiculously, misconceived. My thinking is described in more detail in ‘The Map is not the Territory’.