In London I am often asked to give talks about developments in the finance sector to a general audience. One question which routinely comes up is “what do people who work in the finance sector, in those large office blocks and in the City of London and Canary Wharf, actually do?” And the answer I give is that, to an extent that almost defies belief, what they do is trade with each other.

World trade in goods and services has expanded greatly since the Second World War. But today the volume of global trading in foreign exchange is a hundred times the volume of global trade in goods and services.[1] The total value of exposures under derivative contracts amounts to between two and three times the total value of all the assets in the world.[2] And when I wrote about this process of financialisation in 2014, I highlighted the activity of a company called Spread Networks in building a telecommunications link across the Appalachian Mountains to reduce the time to transmit data between Chicago and New York from 7.3 to 6.6 ms. Since then, improvements in microwave technology have reduced the time required to something closer to the physical lower bound, which is the four milliseconds it takes for light to travel between the two cities.[3]

My description of this activity typically prompts further questions. The obvious one is “what is the purpose of all this activity?” And a more sophisticated version of that question asks “what value-added can be gained from a group of people trading paper claims on existing assets with each other in secondary markets?”

Of course there can be no doubt that finance is indispensable to modern economies.[4] We need finance for four primary purposes. The payment system is the essential utility of finance, the mechanism by which we receive our wages and salaries, pay our bills and enable businesses to transact with each other. A second role of finance is to allow wealth management. We need to finance education when young, retirement when old, and we need to save in the intervening years in order to make these things possible.

Wholesale financial markets as they operate today are directed at two other functions – capital allocation, the process of directing funds from savers and investors to companies and borrowers, and risk management, the business of reducing the costs of bearing the risks inseparable from modern economic and social life.

My introduction to modern developments in finance came when I became involved in the process of reconstruction in the Lloyd’s insurance market, following the near collapse of that market at the end of the 1980s.[5] Lloyd’s came into being in the 17th century. The institution famously originated in Edward Lloyd’s coffee shop, where English gentlemen would gamble on many things, including the fate of ships and the state of tides. Lloyd’s remains today the centre of the global marine insurance market, but by the 20th century had come to be predominantly a reinsurance market.

Lloyd’s was above all the place to which brokers would bring idiosyncratic risks. The modus operandi was that a lead underwriter would price the risk and take a proportion of it. Other underwriters operating from what was known as “The Room’, literally a large room, would follow that lead and determine what proportion of the overall risk they were prepared to take. The system worked on the basis of mutual knowledge and respect within the underwriting community.

But by the 1980s, the market had changed. Aggressively entrepreneurial Lloyd’s brokers realised that if you could sell reinsurance you would also sell reinsurance of reinsurance. And reinsurance of reinsurance of reinsurance. In what became known as the LMX spiral, complex contracts were constructed which involve multiple layers of insurance, in which it was simply impossible to drill down and identify the structure of the underlying risks. All that could be done was to model some of these contracts and establish that in the past nothing would have been paid out on them.

The market had changed from one in which the process was primarily one of mutualisation of risks to one in which risks were being transferred from people understood a lot about them to people who knew little.

I recall two particular moments of revelation as I learnt about these market developments. I asked how much of the growth in business, of which the market was so proud, had come in ‘through the front door’, as distinct from being generated within the market itself. My surprise was not just that it took time to establish the answers, but that people were surprised by the question. Another salutary exchange was when I asked a particularly arrogant underwriter to explain why he had not ’blown the whistle’ on the colleagues whose incompetence he had been denouncing with such vehemence. His answer was simple. ‘Because they were willing to buy risks at prices at which I was delighted to sell them.’ The market had changed from one in which the process was primarily one of mutualisation of risks to one in which risks were being transferred from people understood a lot about them to people who knew little. The trading of risks within the market was not spreading these risks but concentrating them in the hands of those who did not realise what they were doing.

And so it proved when a series of disasters hit the insurance industry generally and the Lloyd’s market in particular in the late 1980s. The first such incident was the destruction by fire of Piper Alpha, an oil rig in the North Sea. That loss was then the largest single marine insurance claim ever made, and it turned out that the total volume of claims at Lloyd’s which resulted from it amounted to more than ten times the original value of the loss. People who had never heard of Piper Alpha had in fact insured it over and over again. And that was how some of the stately homes of England were emptied of furniture in order to meet the losses of Lloyd’s names.

All this was preparation for understanding what was happening in the rapid credit expansion from 2003 to 2007. During that period I found myself asking ‘who are the equivalent in credit markets today of those stately homeowners who did not understand the magnitude of the exposures which they had assumed?’ In 2008 we found the answer to that question; much of the exposure lay in large banks, many of them in Europe.

The widespread trading of credit exposures began with the securitisation first of mortgages and then of other loans in the 1980s. The shift in emphasis from syndication of primary issues to secondary markets in securities originated by a single lender directly paralleled the prior developments I had observed at Lloyd’s. But these changes represented only a small part of the overall process of financialisation of Western economies, the putting of finance at the centre of economic life, which gathered pace steadily from the 1960’s. The nature of equity markets changed also.

The equity markets with which we are familiar came into being in the 19th century to finance railways and railroads. Railways and railroads were capital intensive projects, and the capital required was specific to that particular use. There is little you can do with a railway except run trains on it. The savings needed were collected in modest amounts from large numbers of moderately well-off individuals. These individuals bought both equity and bonds in the new enterprises, and were provided with a degree of liquidity through expanded capital markets.[6]

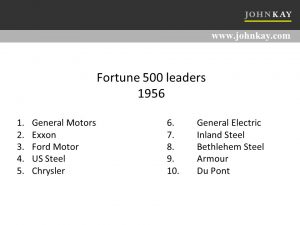

This financing model, then closely bound up with imperialism and the development of the  interior of the United States, was then extended to resource companies, and in due course to the manufacturing businesses which came to dominate Western economies in the course of the 20th century. The zenith was reached in mid-century – in the first Fortune 500 list in 1956, nine out of the 10 top companies were manufacturers. Among them were three automobile companies and three steel companies.[7]

interior of the United States, was then extended to resource companies, and in due course to the manufacturing businesses which came to dominate Western economies in the course of the 20th century. The zenith was reached in mid-century – in the first Fortune 500 list in 1956, nine out of the 10 top companies were manufacturers. Among them were three automobile companies and three steel companies.[7]

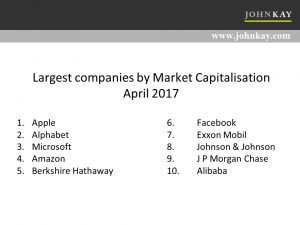

If one looks at the 10 largest companies by market capitalisation today, the picture has radically changed. The list is dominated by new economy businesses – Apple, Alphabet (Google), Amazon, Microsoft and Facebook. There is only one manufacturing company on the list – and that, Johnson & Johnson, is a very different kind of business from the steel and automobile makers of 50 years before. Berkshire Hathaway, sui generis, includes manufacturing businesses among its collection of investments.[8] That company may be at once a relic of the past and portent of the future – the era of the diversified manufacturing conglomerate is coming to an end, but the holding company and the private equity house which internalizes the process of capital allocation are direct responses to the excessive costs, burdensome regulation, and weak governance characteristic of modern public equity markets.

Apple, Alphabet (Google), Amazon, Microsoft and Facebook. There is only one manufacturing company on the list – and that, Johnson & Johnson, is a very different kind of business from the steel and automobile makers of 50 years before. Berkshire Hathaway, sui generis, includes manufacturing businesses among its collection of investments.[8] That company may be at once a relic of the past and portent of the future – the era of the diversified manufacturing conglomerate is coming to an end, but the holding company and the private equity house which internalizes the process of capital allocation are direct responses to the excessive costs, burdensome regulation, and weak governance characteristic of modern public equity markets.

Apple’s market capitalisation today exceeds $800 billion, and Alphabet the holding company for Google, is not far behind. For both these companies, operating assets account for about $30 billion of that value. Modern businesses like these employ very little capital, and such assets as they do use mostly need not be owned by the company that operates from them and typically are not.

As a source of capital for business, equity markets no longer register on the radar screen[9]. In Britain and United States, the countries with the largest equity markets, funds withdrawn from these markets through acquisitions for cash and share buybacks have recently routinely exceeded the amounts raised in rights issues and IPOs.

At the same time, savings have become institutionalised. Initially such institutionalisation took place mainly through the investment activities of pension funds and insurance companies. Today much of their activity has been outsourced and while pension funds and insurance companies are still important players, the equity investment chain is today dominated by the major asset managers – Blackrock, Vanguard, Fidelity and their competitors. And sovereign wealth funds are an increasingly important fraction of public market equity ownership.

…although [end users of finance] have less and less need for market activity… the volume of market activity has increased exponentially

The paradox of modern capital markets is that although there is less and less need for market activity from the point of view of either the end users of finance, or the investors who are the ultimate beneficiaries of finance, the volume of market activity has increased exponentially. And yet policy towards capital allocation places more and more emphasis on markets. European regulation, centred inevitably around acronyms, finds M as its most frequent abbreviation, so we have MAD, the Market Abuse Directive, rather than CAD, the customer abuse directive, as though it were the market rather than the customer which required protection. The centrepiece of European financial regulation is MIFID, the Markets in Financial Instruments Directive. And today the primary objective of European financial policy is to create a capital markets union.

We have extensive discussion in Europe today of the promotion of ‘simple, transparent, standardised securitisation’. It is intrinsic to securitisation that it is neither simple nor transparent. And the belief that mortgages could advantageously be standardised and securitised, perhaps with the assistance of government agencies, led more or less directly to the 2008 global financial crisis. The notion that securitisation is the answer to deficiencies in the availability of small business finance can only be promoted by people, whether policy makers or lobbyists for investment banks, who have no idea what is really involved in the provision of small business finance.

The growth of secondary market trading at the expense of an understanding of the underlying exposure led to disaster in the global financial crisis of 2008, just as it had earlier led to disaster at Lloyd’s. If we think for a moment outside the context of financial markets, we see how rare it is in the modern economy that transactions are anonymous; even our everyday purchases are not simple or transparent or standardised. For small value transactions we rely on the reputation of the seller, for larger value transactions we make our own specific enquiries.

The notion that through standardisation of financial transactions we can resist the universal tendency away from standardisation in markets of all kinds represents a fundamental misunderstanding of basic economics. Standardisation is not an answer to the problem of information provision in financial markets, nor is pervasive information asymmetry successfully resolved by insistence on the provision of detailed financial information on a standardised basis, whether in company accounts or key features documents.

I have described how excessive trading amongst intermediaries is created not solved the problems we encounter in markets for risk, markets for debt, and markets in equity securities. I believe it is time to raise question marks over the entire market based model of financial services provision. We should be talking about risk management and capital allocation without any presumption that markets are the best way of handling these issues.

It is instructive to look at the economic role that many of the new economy companies I described above now play. The primary role of intermediaries like eBay and Amazon is to enable people to transact with confidence with suppliers and providers of whom they themselves have no knowledge. Even more strikingly, Uber and Airbnb are innovative business models which have come into being to serve precisely this function; to replace traditional structures of regulation or lengthy and complex chains of intermediation by providing immediate verification of the reliability of both buyer and seller.

I think the future of peer-to-peer lending is that the institutions which survive… will increasingly resemble the organisations which we used to call banks.

The rise of Uber and Airbnb is a forceful illustration that although we need less intermediation in financial markets than we have today, the right level of intermediation in future is not zero. Some people take the view that disintermediation through peer-to-peer lending and crowdfunding will transform the provision of finance to individuals and businesses. I am sceptical of this claim. The thesis I have been developing is that both investment and risk transfer are unavoidably heterogeneous, idiosyncratic transactions. In consequence, algorithmic scoring can never replace, although it may be able to assist, a qualitative and quantitative assessment of an experienced loan officer or shrewd investor. Like most people interested in business, I have never seen a business plan for a start-up which did not look superficially promising. It is only once you have seen 20 or 30 similarly promising proposals, and have experience of what happened to them, that you are able to begin to distinguish effectively between the effective entrepreneur and the perennial optimist. I think the future of peer-to-peer lending is that the institutions which survive fraud, losses and increased regulatory scrutiny will increasingly resemble the organisations which we used to call banks.

An intermediary who genuinely adds value will generally be one who has some specialist knowledge of one or both of the end-users of finance

The appropriate number of intermediaries in finance is in most cases somewhere between one and two. An intermediary who genuinely adds value will generally be one who has some specialist knowledge of one or both of the end-users of finance – either the borrowers and the beneficiaries of equity investment, or the depositors and investors whose savings are necessarily the ultimate source of such finance. A few minutes on a trading floor today demonstrates that the principal knowledge many intermediaries have is that of the behaviour of other intermediaries.

When I was a schoolboy in Scotland in the 1960s, joining the Bank of Scotland or the Royal Bank of Scotland was a career for the boys in my class who were not going to get good enough grades to go to leading universities. Even when a few years later I began my teaching career at Oxford, careers in the City of London were mostly for undergraduates who were not academically distinguished but nevertheless socially polished and well-connected. All that has changed, and not altogether for the better, as was evident when the Bank of Scotland and the Royal Bank of Scotland failed in 2008, after three centuries of prudent success, under the stewardship of able individuals with good degrees from the finest universities and business schools.

Larry Summers, former president of Harvard and US Treasury Secretary, once observed that finance had once been the preserve of people whose primary skills were those of good companions at the 19th hole of the golf course, but had become the province of people with the sophisticated mathematical skills required to price complex derivatives.[10] Summers, with skills better adapted to solving differential equations than conviviality at the 19th hole, noted this shift with evident approval. I am not so sure.

Footnotes

[1] Bank for International Settlements,Triennial Central Bank Survey of foreign exchange and OTC derivatives markets in 2016; World Trade Organisation, World Trade Statistics 2016

[2] Bank for International Statistics, semi annual derivative statistics, June 2017; Credit Suisse Global Wealth Report, 2016

[3] Donald MacKenzie (Edinburgh): “A Material Sociology of Markets: the Case of ‘Futures Lag’ in High-Frequency Trading” (Auguste Comte Memorial Lecture) February 2017

[4] See, for example, the survey in R Levine, ‘Finance and Growth: Theory and Evidence’, in Handbook of Economic Growth, Philippe Aghion, Steven Durlauf – Elsevier/North Holland – 2014

[5] See Duguid, Andrew. On the Brink: How a Crisis Transformed Lloyd’s of London. Houndmills, Basingstoke, Hampshire: Palgrave Macmillan, 2014. for a description of this crisis

[6] Hannah, Leslie, The rise of the corporate economy, Routledge, 2010

[7] archive.fortune.com/magazines/fortune/fortune500_archive/full/1956/

[8] At May 2017, the others were JP Morgan Chase, Exxon Mobil and – significantly – Alibaba

[9] See the Kay Review, https://www.gov.uk/government/publications/kay-review-of-uk-equity-markets-and-long-term-decision-making

[10] On Economics and Finance – Lawrence Summers – The Journal of Finance – 07/1985

Image: Pixabay

Apple’s (gross) operating assets closer to $300m than to $30m — though still an incredibly low number I agree

Thanks, although it should be US$30 billion, not million. Cash is not an operating asset in this sense.

Intuitively my heart agrees that a little more common sense and exposure to real business finance is a safer background than being a pure quant.

But the quants may yet recover from their setback. Algorithmic scoring is the dinosaur ancestor of tomorrow’s machine learning systems, I say this in dread as much as awe. Such systems will be asked to replace human assessment. In fact, we customers willingly invite them in to our lives. As a developer, the more exposure I have to the workings of machine learning systems, the more I fear their future learning ability. An angel investor may have had experience with 20 start-ups, but machines will one day learn every detail (you would be astounded by the detail available) from thousands of start-ups. Yuval Harari Noah’s “Homo Deus” outlines the plausible set of events that lead to practical people handing over key life and investment decisions to machines. Worth a read, relevant parts in chapter 9, esp. around p392.

Edward Lloyd, not Thomas (at least according to Lloyd’s website- https://www.lloyds.com/lloyds/about-us/history , and the blue plaque in Lombard Street).

Thanks, amended.