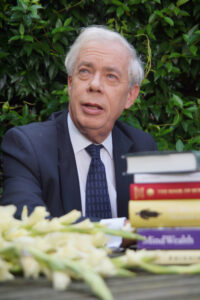

Sir John Kay is an economist whose career has spanned the academic world, business and finance, and public affairs. He has held chairs at the London Business School, the University of Oxford and the London School of Economics, and is a Fellow of St John’s College, Oxford, where he began his academic career in 1970. He is a Fellow of the British Academy and of the Royal Society of Edinburgh.

He is the author of many books, including The Truth about Markets (2003), The Long and the Short of It (2009, new revised edition 2016), Obliquity (2010) and Other People’s Money (2015). Radical Uncertainty, jointly written with Mervyn King, was published in March 2020. Greed is Dead, co-authored with Paul Collier, was published in July 2020. His latest book The Corporation in the 21st Century was published in August 2024.

I was born in Edinburgh, Scotland in 1948, and completed my schooling and undergraduate education in that city. My mother continued to live in Edinburgh and when she died at the end of 2006 I thought my visits to Scotland would become less frequent. But when Alex Salmond because First Minister of Scotland after the election in May 2007 he invited me to join the Scottish Government’s newly established Council of Economic Advisers, and this has meant more contact with my Scottish roots. I am fortunate to have lived most of my life in beautiful places. I went to the University of Edinburgh to study mathematics. But, after taking a subsidiary course in economics, I decided that I wanted to be an economist.

The notion that one might understand society better through the application of rigorous and logical analysis excited me – and it still does.

After graduating, I went to Nuffield College, Oxford. I worked there under James Mirrlees, who was in due course to win the Nobel Prize for his contributions to economic theory. On Mirrlees’ advice, I applied for and to my astonishment got a permanent teaching post in the University of Oxford at the embarrassingly early age of 21. Oxford is a collegiate university – members of the faculty generally have both University and College appointments. This post carried with it a fellowship at St John’s College, an association which I have maintained and enjoyed ever since.

Through the 1970’s I developed a conventional academic career, publishing in academic journals, and writing my first book Concentration in Modern Industry (with Leslie Hannah, an economic historian colleague). My particular interests were in public finance and industrial organisation. But my rationale for studying economics had, from the beginning, been concerned for application. My career began to change direction when I was asked to join a group to review the structure of the British tax system. This group was established under the auspices of a newly established think tank, the Institute for Fiscal Studies, and was headed by James Meade, another economist who had achieved the ultimate distinction of a Nobel prize. Meade’s rigour was as demanding as that of Mirrlees, (both delivered it with considerable personal charm). But the most important effect of my experience with the Meade Committee was that I began to develop a taste for the popular exposition of economic concepts.

In this vein, I wrote (with Mervyn King, now Governor of the Bank of England) a more personal account issues in taxation, The British Tax System which ran through five editions. Pursuing these interests, I moved from Oxford and joined the Institute for Fiscal Studies as its first research director. Soon after I became Director of the Institute. IFS developed into (and remains) one of Britain’s leading think tanks, respected and feared by policymakers and journalists for its fiercely independent analysis of fiscal issues.

After seven years, I decided it was time to move on. The success of IFS had been built on serious economics accompanied by a commitment to popularisation and application. If this could be done for public policy issues, could the same be done in the area of business policy? This was the thinking that led me to accept a chair at the London Business School in 1986 and, at the same time, to establish a consulting company, London Economics.

Over the next few years, the application of economics to business issues became my intellectual focus. During this period, London Economics grew rapidly, largely on the back of the wave of privatisation and regulatory change in Britain in the 1980’s. By 1991, managing the company had become a major responsibility. I revised my arrangements with London Business School. My new contract was as Visiting Professor but my job as executive chairman of London Economics took the larger part of my time. London Economics grew until, by its tenth anniversary, its annual turnover exceeded £10m with offices in three continents and assignments in over sixty countries.

London Economics gave me insights into the business world. These came both through consultancy work with major corporations and first hand observation of the growth and development of a small business.

Other activities have enriched my more scholarly work by broadening the experience on which it draws. I have been a director of several investment companies, and was for nine years a director of Halifax plc, one of the largest retail financial services businesses in Europe (and left the board well before the events which led to its disastrous collapse in 2008). Other tasks have included membership of the task force which began the process of reviewing the Lloyds insurance market, acting as a director of the Investors Compensation Scheme, and being a member of the steering group for the government’s review of company law.

What I write and think today is a product of a combination of this practical knowledge of the business world and an academic training in industrial economics. (Although the industrial economics of today is very different from that which I learned as a student: oddly both more relevant to business problems and more distant from them.) Some of the results of this can be found in Foundations of Corporate Success (1993) (an American version is Why Firms Succeed (1995)) and The Business of Economics (1996). And in the column which I have written for the Financial Times since 1995. Since 2004 this has been a weekly op-ed piece, which currently appears on Wednesdays.

In 1996 I was attracted by the idea of going back to Oxford to help establish a new business school there and gave up the Chairmanship of London Economics to take the Directorship of the newly created Said Business School. So I became, improbably, Professor of Management at the University of Oxford. And when, in 1997, I became the first Professor of Management to be elected a Fellow of the British Academy, it became possible to believe that the study of business was, even in Britain, achieving intellectual respectability.

The last decade has been a bizarre period in which to be a business economist and never more so than in 1999 and early 2000, when the greatest speculative bubble in economic history expanded far beyond reason – and finally burst. Never were the principles of business economics so much on trial, as once serious commentators proclaimed that old principles of evaluation were redundant and the rules of business success had entirely changed. And, of course, these principles were vindicated in the end. The answer to those who shook their heads and told adherents of the old rules – like me – that they ‘just didn’t get it’ was that there was very little to get.

At the end of 1999 I became seriously ill and, although recovery from that seems to be complete, it left me with an ongoing determination not to do things that weren’t enjoyable and productive. Mostly, that has been popular writing with a serious theme. In August 2002 I completed The Truth about Markets, which was published in the UK and Europe in 2003 and as Culture and Prosperity in the United States in 2004. The book has now been translated into several other languages.

The core argument of The Truth about Markets was that although the evidence that the market economy was a superior model of economic organisation was overwhelming, the commonly presented description of how markets worked was a travesty. This account, which I described as ‘the American business model’ treated greed as dominant human motivation, emphasised a kind of market fundamentalism, and limited the role of the state to little more than the enforcement of property rights and contract, and perhaps the provision of a basic welfare safety net. This is not even a good account of the American economy: there are many different kinds of market economy, each the product of a particular social content. This argument has only been strengthened by subsequent events.

In 2004, I published a book of collected columns on economic subjects – Everlasting Light Bulbs – and in 2006 a selection on business issues – The Hare and the Tortoise. There were three major themes to reading, writing and reflection over that period: the relationship between business and society: the nexus between politics and society: and the ways in which we make decisions in a world characterised by fundamental uncertainty.

Obliquity originated as a long article I wrote in the Financial Times in 2004, on the theme that complex goals were rarely best achieved through direct pursuit: the happiest people were not those who pursued happiness, the wealthiest people not the most materialistic, the most profitable companies not the most profit oriented. Further reflection on the how and why of this thesis led to my latest book, Obliquity, published in the UK in 2010 and in the US in 2011.

The financial crisis of 2007-8 has dominated subsequent discussion of economic policy. In my view the responses are characterised by two widespread misunderstandings. The first mistake is to believe the crisis is an inexplicable, once in a lifetime, event, rather than another demonstration of an increasingly dysfunctional financial system. The second error is an extreme naiveté about what regulation can achieve. In various articles, and in an extended essay Narrow Banking, published in September 2009 by the Centre for the Study of Financial Innovation, I have tried to set out these views and their implications. The issues could hardly be more important. I also thought there was a need for a guide for bemused individuals who wanted to understand what was happening and get practical guidance as to how to steer through it. The theme of The Long and the Short of It published in January 2009 is how to take financial management into your own hands.

The crisis also raised questions about the nature and role of economics itself. I have been keen to take part in this debate, and among other initiatives have joined the advisory board of the Institute for New Economic Thinking established with a major donation from George Soros.

Today there are more subjects of urgent importance to write about than time to write. I plan to work on the economics of rents and rentseeking, present more material on the role of the financial sector, on Scotland, on Europe.

The key to my own judgments is a firm belief that markets are embedded in a social context, and that this is central to an understanding of how they work. Fukuyama, borrowing Nietzsche’s striking phrase, wrote of the end of history after the fall of the Berlin Wall. In late 20th century American progressive opinion, in a combination of lightly regulated capitalism and liberal democracy we have arrived, once and for all, at the right answers to problems of social and economic organisation.

I believe that this description of how market economies function is certainly superficial, and even wrong. I share the commitment to market economics and market economies. But I see the social context of markets not as a sideshow but as an integral part of how these markets work. With the widespread view, sometimes called the ‘Washington consensus’ that well-defined private property rights, active capital markets, and free internal and external trade, are necessary and sufficient for economic success. I believe it is the absence of an appropriate social context that provides the explanation of why the ‘Washington consensus’ has so often failed, just as socialism failed: both ideas rely on principles deduced in abstraction from the reality of the environment within which it was intended to function.

This social context is essential because

- modern economies need and process complex information. Asymmetry of information in transactions can only be handled by a range of rules, conventions and relationships between traders

- small group interactions frequently have pathological properties which need to be handled by contracts and conventions, by participation in hierarchically structured organisations, and by the development of sustained relationships

- many markets for risks do not and cannot exist: since the cost of insecurity to individuals may be very high, social as well as economic institutions for risk sharing and risk pooling are needed and are found in all societies

- property rights are not, in any but the simplest of economies, obvious or natural: they are social constructs and there are many different possible property rights régimes.

Such reasoning denies the possibility of a single model, or blueprint, for economic systems. Properly functioning businesses, and markets, are particular products of specific social contexts and cannot easily be created outside of these contexts. These themes are developed in The Truth about Markets (2003) (published in the US as Culture and Prosperity).

My conviction that markets operate in this way derives from my business experience. That persuaded me that firms should not be regarded as instrumental institutions; I therefore reject the “transaction cost market versus hierarchy” approach to the business organisation described by Ronald Coase and Oliver Williamson in favour of the resource based view, initially described by Edith Penrose.

The resource based theory is one of the principal strands of thought in business strategy today. My own contribution to it is contained in Foundations of Corporate Success (1993) or Why Firms Succeed (1995): for a briefer version see the FT’s introduction to “Mastering Strategy”.

Resource based theory sees the firm as a collection of assets, or capabilities. In the modern economy, most of these assets and capabilities are intangible. The success of corporations is based on those of their capabilities that are distinctive. Companies with distinctive capabilities have attributes which others cannot replicate, and which others cannot replicate even after they realise the benefit they offer to the company which originally possesses them.

Business strategy involves identifying a firm’s capabilities, putting together a collection of complementary assets and capabilities, and maximising and defending the economic rents which result. The concept of economic rent is central in linking the competitive advantage of the firm to conventional measures of performance – read more in Foundations of Corporate Success in an article first published in Finance Director.

The idea of a firm as a collection of capabilities contrasts with two common and more individualistic views of the firm. One, prevalent in US business journalism, is that companies are essentially extensions of larger than life chief executives – General Electric is Jack Welch, Microsoft is Bill Gates. The other, more widely held amongst economists, is that we can ‘look through’ firms to the individuals who have relationships with them. In this reductionist view shareholders, too numerous and too busy to manage firms themselves, hire managers to run the firm on their behalf. These managers then make contracts with employees, suppliers, and customers.

But companies which could be satisfactorily characterised in either of these ways would not make profits. Successful firms have distinctive capabilities. The value these firms add results from this particular identity and their characteristics cannot simply be defined by the contracts they have made. In a profound sense – a sense which is commercial and moral as well as legal – such companies have a reality, and a value, separablefrom the individuals who contribute to them.

From this perspective, it hardly makes sense to talk about the ownership of a modern company. A large, successful corporation is necessarily a social institution, and would not survive if it were not. This position has political as well as economic implications. This leads to the economics of “stakeholding” – see Prospect and my inaugural lecture at the Said Business School.

Firms are not the product of grand designs. The same is true of economic systems. Attempts to establish economic systems on the basis of abstract blueprints in Eastern Europe, Russia and the third world have led to lamentable failures. In the last decade this failure of rationalism has been as true of the blue prints of the right as it was previously true of the blueprints of the left.

In other disciplines, the modernist view that systems and knowledge can be derived from entirely general first principles has come and gone. In architecture, for example, the twentieth century view that ‘a house was a machine for living in’ – entirely rational, functionalist – has given way to post-modernism. Architectural rationalism discarded much that was valuable, but tacit rather than explicit, in the classical tradition and the emphasis on functionality in modern architecture proved ultimately not even to be functional. (You can read more in an article I wrote in the Financial Times on 29 April 1998.)

Yet economics and business are today the last bastions of modernism. There is still a firmly rooted belief that there are right ways of organising firms and economies, not just for here and now, but as universal maxims: and that in matters of business and economics sensitivity to culture, context, tradition and history are unaffordable sentimentality.

I disagree profoundly with this modernist position. Social phenomena can never be successfully understood or analysed in this way. There are many perspectives – literary, anthropological, economic – on the ways in which we behave and in which our society is organised. Each of them has a measure of truth, neither is the whole truth.

This thinking provides the basis of my forthcoming book Obliquity on the theme of how complex goals are best pursued indirectly. It will be published by Profile in March 2010.

Since the credit crisis, many questions have been asked about the future of the subject of economics: questions still raised more often by those who are not professional economists than by those who are. But I suspect in the medium to long term, very large changes will have occurred: that the focus of the subject will be considerably different from the dominant paradigm which I have learnt, taught, written about (and, for many years, subscribed to) during my career.

Financial economics is today the subject of a pincer movement. On the one hand, softer behavioural approaches derived from psychology and anthropology supplement or displace models which impose assumptions of supposed validity on complex individual behaviour: on the other hand, heavier duty mathematics than that used in the traditional equilibrium and optimisation frameworks of economists can be helpful in the understanding of market prices. To a surprising degree, these approaches turn out to be two sides of the same coin, since the processes implied by the first approach may often be best represented by the second.

I conjecture that economics will develop in much the same way, becoming more inter-disciplinary – not in a woolly sense, but better rooted in a psychology which is itself more firmly based on neurophysiology and an appreciation of both cultural and biological evolution, and drawing on a range of scientific techniques rather than the too vigorous pursuit of analogies with classical mechanics. But these are matters for – perhaps – another book.